Co přinese dnešní Fed?

Dnes zasedá Fed a je to poslední zasedání před ostře sledovanou konferencí v Jackson Hole. Může Fed oznámit další vlnu kvantitativního uvolňování? Nebo počká až na Jackson Hole? Nebo neudělá vůbec nic?

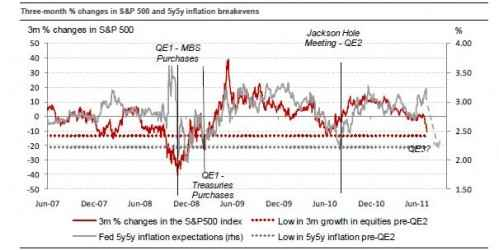

Podle analytiků z firmy Nomura je možné oznámení QE3 co nejdříve. Níže uvedený graf stojí za pozornost.

Podobnost aktuálních údajů s daty v době oznámení QE2 resp. QE1 není zanedbatelná. Inflační očekávání jsou velmi podobná těm před oznámením předchozích QE. Inflace se tak po zkušenostech s minulým vývoje Fed podle všeho bát nebude. Také vývoj cen akcií je podobný. Před rokem činil pokles 13%, letošní po započtení včerejšího propadu je na 16%. Mimochodem, jak jsem včera večer psal na facebook a twitter, včerejší propad S&P 500 je šestý největší v historii.

Co přesně řekla Nomura:

Although QE has been effective in lifting asset prices as a band-aid, its impact on expectations of balanced, durable growth remains an open question. Some have argued that the consequences of the form of QE used so far have been negative for global growth via higher commodity prices. Repeating the experiment in exactly the same way may not be as easy as the discussions we have had with clients would suggest – especially now that we have hard evidence that other global market participants are nervous about fast USD weakening.

However, all this ignores the other major difference from 2010 – increased sovereign risks. How those play into monetary policy decisions is not clear yet – more or less supportive of accommodation? It is this uncertainty that makes us nervous about ascribing a high probability of QE3 as a risk market saviour – or that if it is a relative game, that substantial further pain/systemic risk is required in risk assets if inflation expectations do not decline in tandem.

Po zítřejším zasedání Fedu není plánována žádná tisková konference, čeká se jen tiskové prohlášení. Investoři tak budou studovat každé slovo, jakoukoliv odchylku oproti minulému prohlášení. Proto přidávám klíčové věty z červnového prohlášení:

… the economic recovery is continuing at a moderate pace … The slower pace of the recovery reflects in part factors that are likely to be temporary … Inflation has picked up in recent months …

The unemployment rate remains elevated; however, the Committee expects the pace of recovery to pick up over coming quarters and the unemployment rate to resume its gradual decline … Inflation has moved up recently, but the Committee anticipates that inflation will subside to levels at or below those consistent with the Committee’s dual mandate as the effects of past energy and other commodity price increases dissipate. …

… The Committee continues to anticipate that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

V červenci ve vystoupení před Kongresem B. Bernanke uvedl, že případné QE3 bude záviset na dvou faktorech současně – na ekonomickém oživení a na míře inflace či deflace. Klíčové tak bude sledovat, zda a případně jak se změní hodnocení těchto dvou faktorů.

Vzhledem k vývoji v posledních dnech bych nějakou formu podpory od Fedu očekával. Možná Fed neoznámí přímo QE3, ale podle mě to směřuje alespoň k „QE 2,5“. QE3 by pak mohlo být na řadě zřejmě při pravidelném projevu v Jackson Hole v posledním srpnovém týdnu.

Jak to celé dopadne se dozvíme dnes odpoledne. Ceny akcií i drahých kovů budou podle toho reagovat.

Přidat komentář

Pro přidávání komentářů se musíte nejdříve přihlásit.

este vcera som mal 30% portfolia short

dnes som uz 100% long

stavil som na bena a jeho zelene papieriky 🙂

pookud so dobře pamatuji, v roce 2008 byly i dny s 10% růstem indexů…

Já zase vsázím na drahé kovy

ja si myslim ze primo qe nevyhlasi. Pouze si pripravi pudu. Proto je mozne ze se dockame toho co uz mnohokrat – tj spike nahoru a potom navrat do normalu. Ale to je jenom vesteni z koule.

Nicmene nektere akcie jsou nyni sqela value, o tom zadna.

Pokud QE3, sázel bych spíše na konferenci v Jackson Hole

tak qe3 zatim nebude, jak jsem predpokladal. Nejvetsim prekvapenim je ze Fisher, Kocherlakota a Plosser hlasovali proti usneseni (resp ze je jich tolik).

btw a vyplach pokracuje (dow momentalne -150)

Dovolim si podelit se o zpravu ktera ted koluje mezi mymi Americkymi kolegy:

Day of Reckoning

by Llewellyn H. Rockwell, Jr.

The trigger that apparently caused the market meltdown was the ever-so-slight suggestion from Standard & Poor’s that the US government’s fiscal health might not be all that it is cracked up to be.

This was not a case of the little boy noting the emperor has no clothes. It is more like the little boy suggested that the emperor’s clothes, while beautiful, might have been more carefully tailored to suit the imperial dignity. Hysteria followed, and the entire Obama cult called for the kid to be stoned.

Finally the emperor himself spoke in defense of his rainment. That’s when the market crashed.

But the downgrading of a government’s debt from AAA to AA+ can only have triggered a market avalanche if the truth is in fact much worse, and most everyone knows it.

S&P doesn’t have clean hands, of course. It holds a government monopoly, wants higher taxes, and rated crazed housing bonds AAA. But imagine, for just a moment, that US government debt were rated in the same way that municipal bonds or regular corporate debt are. Imagine that government bonds, like normal bonds, carried a default premium. Imagine, in other words, that the Federal Reserve were not in a position to pay everyone from welfare recipients to banksters with newly created money.

Under such actual market conditions, federal debt would not be rated as AA+. It would be worth even less than junk bonds. In fact, it wouldn’t even qualify for a market rating at all, because it would be utterly worthless and the institution that issued it would be in default and the whole rotten apparatus of the state would be seen to be bankrupt at its very core, in every sense.

We know this for one simple reason: There is no way that the government can fund its debt on taxes alone. There would be a revolution in this country in a heartbeat, and, probably, the entire American empire, domestic and foreign, would come crashing down, along with its banking and monetary systems.

If this actually happened, there would be no more „ongoing negotiations“ about the budget and the debt. The cuts would be swift, extreme, gigantic. The federal government would have to behave like state governments, balancing the budget year to year. There would be no more plans for fake cuts in the planned increases, gradually phased in over ten years. The federal government would face actual market discipline. The S&P downgrade is only a slight taste of what would follow.

And let’s not just look at the downside. Hundreds of billions in resources would be freed from government control. The private sector would experience a huge infusion of energy. Interest rates would probably go through the roof, which means that people would actually be rewarded for saving, and saving is exactly what people would do as hundreds of banks went belly-up, large portions of the business sector had their credit lines cut, and merchants of death had to close their bloody doors.

There would be wailing and gnashing of teeth, but there would be no turning back. Within a few months, we would start seeing massive resource shifts and pockets of growth would return. New jobs would be available. New businesses would spring up. New financial firms would displace the old ones. Within a year or 18 months, we would be on a growth path, and this time it would be real and sustainable.

Of course this is not going to happen. Instead, the powers-that-be will continue their long game of „let’s pretend“ as the economy sinks deeper and deeper, incomes fall, and the US gradually heads toward 3rd-world basket case status.

It’s not only the government that is bankrupt, of course. It’s the entire ideological apparatus that backs the state and its eternal expansion. The New York Times struggled for something to say about the obvious failure of the second stimulus. All they could come up with was: „shift every available resource toward jobs,“ „increased investment in infrastructure,“ more relief for homeowners, and another extension of unemployment benefits.

The only thing that this asinine editorial left out was the need to lower interest rates. And that’s because interest rates are already 0%, which has killed saving, terminated growth, and denied the public the fundamental freedom to sock away money in time deposits and let it earn something in exchange. The Federal Reserve is completely out of policy options, unless it is ready to embrace the Zimbabwe-Weimar solution.

Of course, the whole theory that the government can stimulate through control and robbery is wrong and counterproductive. It only ends up rewarding government and its friends while the rest of us suffer. If we ever get out of this depression, it will be because government is forced to stop this nonsense, and the economy really stimulated by taking a meat axe to the planning-spending-inflating apparatus.

This is the underlying reality that informed traders understand. The whole system is being propped up by the power to print, and that power alone. No matter how many miracles some people think that paper money can accomplish, there is an underlying realization that the whole system is a hoax.

But don’t take my word for it. Let S&P and many more competitive rating agencies go to town on US bonds and rate them as they would any bond in the private sector or even the public sector not backed by a printing press. Let reality speak, and let us listen.

August 10, 2011

Dík, já doporučuji ještě k přečtění tohle:

https://ftalphaville.ft.com/blog/2011/08/10/649506/the-grantham-manifesto/

A pridavam jeste jeden zajimavy nazor:

Who’s Really Downgrading America?

by Patrick J. Buchanan

The decision by Standard & Poor’s to strip the United States of its AAA credit rating, for the first time, has triggered a barrage of catcalls against the umpire from the press box and Obamaites.

S&P, we are reminded, was giving A ratings to banks like Lehman Brothers, whose books were stuffed with suspect subprime paper, right up to the day Lehman Brothers fell over dead.

Moreover, S&P made a $2 trillion error in its assessment of U.S. debt and used political criteria in making its downgrade.

All of which may be true. But none of which is relevant.

This downgrade is deeply deserved. For no one really believes the United States is going to pay its creditors back the $14 trillion it owes them, or the $21 trillion it will owe them at decade’s end, with dollars of the same value as those that the United States is borrowing today.

In the last year alone, the U.S. dollar has lost 30 percent of its value against the Swiss franc. A Swiss citizen who exchanged francs for $100,000 in dollars in June 2010 to buy one-year T-bills, then cashed those T-bills in this June, would have gotten back $100,000 in U.S. dollars. But those dollars would now be worth 30 percent less in Swiss francs.

On „Meet the Press,“ Alan Greenspan insisted that the United States is not going to default. Why not? Because our debt is denominated in dollars, and we can print dollars to pay off our creditors. Which is pretty much what Chairman Ben Bernanke and the Fed have been doing.

With the dollar down 5 to 10 percent this year alone against the world’s more respected currencies, we are engaged in what the Romans called coin-clipping – official stealing from citizens and foreigners.

Why are the Chinese so upset?

Because they are sitting on more than $1 trillion in U.S. bonds and Treasury bills bought with dollars we paid them for Chinese-made goods, while the purchasing power of the dollars that those bonds and T-bills represent withers away every week.

„I believe this is, without question, the ‚Tea Party downgrade,'“ says Sen. John Kerry.

How so? Because the Tea Party blocked the big deal President Obama sought to cut with House Speaker John Boehner to resolve the deficit-debt crisis.

The president, we are told, was prepared to accept $3 trillion in reduced future spending for entitlements like Social Security, Medicare and Medicaid, but the Tea Party caucus refused to let Boehner agree even to $1 trillion in „revenue enhancement.“

But here, a question arises: If the president believes entitlement reform is essential to get America’s deficit-debt crisis under control, why does he need Tea Party cover to do his duty?

He doesn’t. Tea Party intransigence on taxes is not the reason for Obama’s failure to cut spending. It is his excuse.

Indeed, if Obama announced tomorrow that he was going to cut future spending on entitlements by $3 trillion to restore our AAA credit rating, he would have the full support of the Tea Party.

His opposition would come from Kerry’s colleagues in the Senate and Nancy Pelosi’s in the House.

To see how absurd it is to blame Tea Party Republicans for the downgrading of America’s debt, imagine this scenario: Rep. Ron Paul is speaker of the House, Sen. Rand Paul is majority leader, and Rep. Paul Ryan is president of the United States.

Does anyone doubt this trio would restore the U.S credit rating in a New York minute? Every sacred cow in the federal pasture, from food stamps to foreign aid, would be hanging in the meat locker.

The American people have come to like the president, but a majority is coming to believe he is simply not the decisive president we need to lead us out of the morass in which he found the country and from which he has failed to extricate us.

„He made it worse!“ is shaping up as the GOP slogan for 2012.

If Obama wishes to restore the AAA rating of his country, he might consider two separate and bold steps, both consistent with his professed beliefs.

First, tell the Republicans that if they will not agree to revenue enhancement, he will nonetheless do his duty and pare back spending in the entitlement programs. He would get instant GOP support.

Following this, he could go to the Republicans and tell them that if they agree to eliminate the clutter in the tax code – exemptions, loopholes, deductions – he will agree to cut tax rates for individuals and corporations alike, to make America more competitive.

Again, he would have the support of Republicans and the Tea Party. It might even advance his re-election prospects, if he could get re-nominated by his own party, which would rebel at both reforms because they would mean a suspension of the politics of tax and spend.

As for the S&P downgrade, again, the only surprise is it didn’t come sooner.

August 10, 2011

https://www.msnbc.msn.com/id/31510813/#44080879

Marc Faber: The Next Crash Will Be Much Worse Than 2008 … Before Then Expect More Money Printing and More War

https://lewrockwell.com/faber/faber116.html

Jeste jeden zajimavy, Criminal Bankers Destroying America – GERALD CELENTE:

https://revolutionarypolitics.tv/video/viewVideo.php?video_id=16006